As the balance shifts, more of each monthly payment begins to reduce the principal balance. Loans are weighted too, with interest-heavy contributions required during early repayment.

Part of the payment is designated to cover interest accumulated during the billing period, while the remaining portion is applied to directly reduce the original principal balance of the loan.

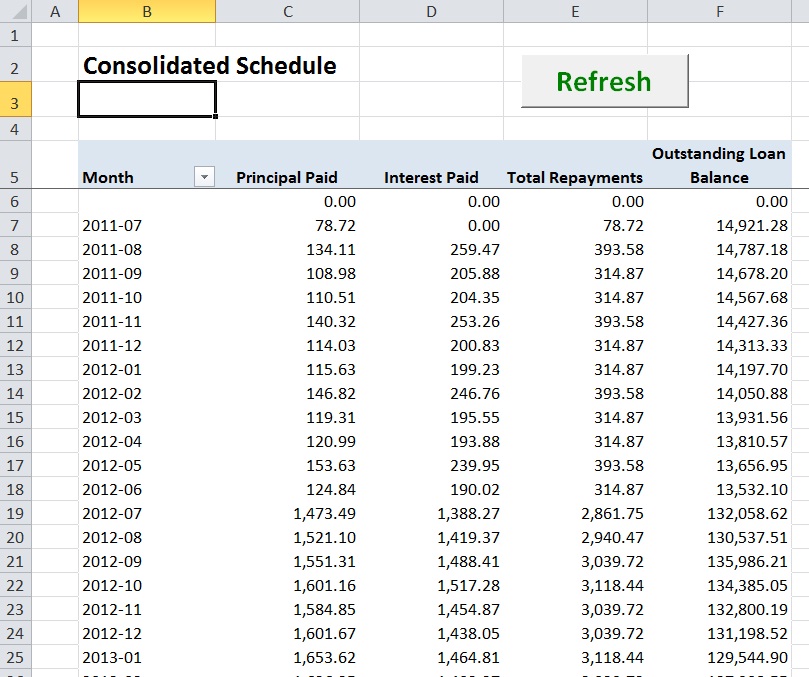

Payment BreakdownsĮach loan payment is broken into parts, which are applied to different areas of your loan responsibility. Even so, add-ons are clearly articulated before contracts move forward, so there are no hidden costs for consumers. Fees and other charges are occasionally built-in to repayment schedules, adding to the overall cost of repayment. Installments are not subject to interest rate fluctuations, so there are no surprises for borrowers along the way. The benefit of consistent payments allows consumers to budget well in advance, ensuring affordability on major purchases like homes and cars. At any point over the course of a mortgage, for instance, borrowers are able to look ahead for precise future payment responsibilities. In fact, when installment loans originate, amortization schedules are provided, illustrating the entire payment progression expected from the borrower. Installment loans, for homes and cars, require the same payment each month, according to terms and conditions contained in loan agreements and promissory notes. The above loan balance calculator allows you to change payments through the loan & sheds light on remaining balances, when inconsistent payments have been made. Payments made in irregular amounts are harder to account for than consistent monthly amounts, leading to difficulty determining loan balances. Regular monthly installments make for clear-cut amortization calculations, but variances in the amount paid each billing period have ongoing impacts on the principal balance left outstanding on loans. Irregular payments are another variable impacting loan balance and repayment timelines. Instead, fees and interest impact the pace of loan repayment.

While it would seem to follow, loan debits are not summarily shaved off the top, reducing principal balance in kind. Simple subtraction doesn't always lead to accurate loan balance calculations.

0 kommentar(er)

0 kommentar(er)